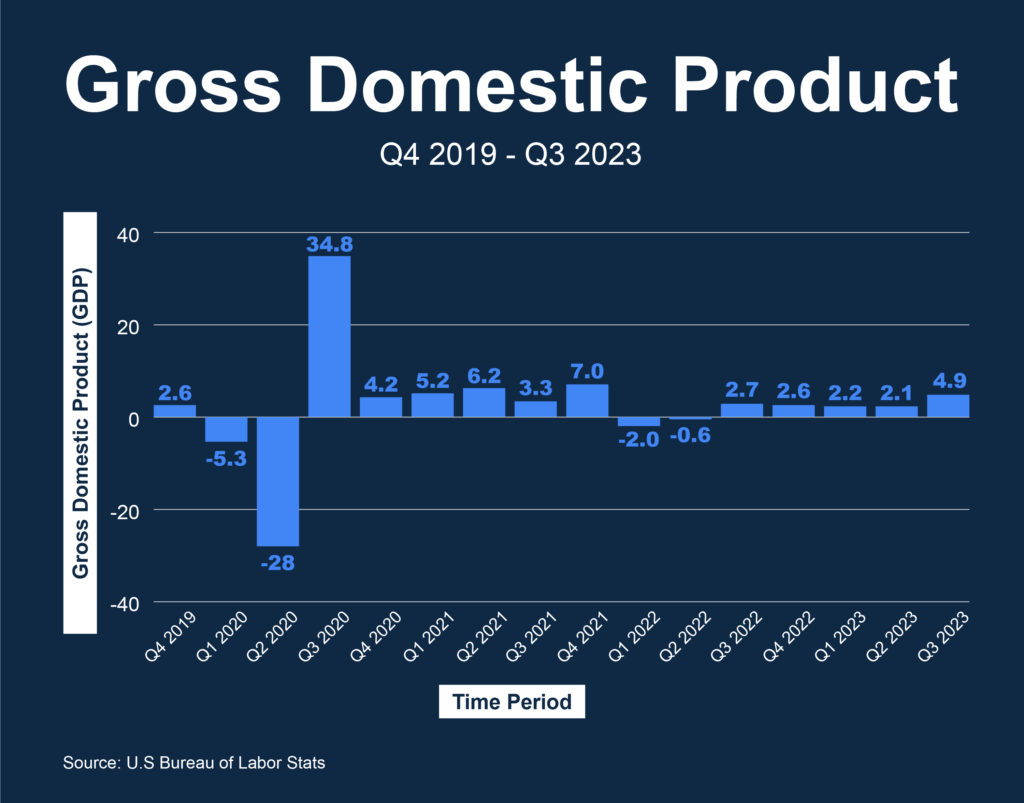

In today’s economic analysis, most indicators remain steady except for GDP. GDP for Q3 2023 came as a surprise, increasing almost 5% compared to Q2. This is one of the best numbers of the past few years. This report continues to zero in on pivotal metrics: the unemployment rate, non-farm payrolls, and the inflation rate as well.

— SEPTEMBER 2023 SNAPSHOT —

• Unemployment Rate: 3.8% (=)

• Inflation Rate: 3.7% (=)

• Interest Rate: Steady at 5.50% (=)

• Business Confidence Index: 49.8 (+2.2)

• GDP Growth Rate: 4.9% in Q3 (2.1% in Q2)

- Unemployment Rate

Unemployment figures remained unchanged at 3.8%

According to JP Morgan, total nonfarm payroll employment rose by 336,000 in September, with the unemployment rate remaining unchanged at 3.8%. On a sector basis, leisure and hospitality employment led the way in September 2023, with 96,000 job additions outpacing the average gains of 61,000 seen over the preceding 12 months. Within the category, food services and drinking establishments added 61,000 jobs during the month, returning to the pre-pandemic level of February 2020. Strong job gains also occurred in government and health care, which added 73,000 and 41,000 positions, respectively. The labor force participation rate remained at 62.8% in September, while the employment-population ratio also stayed unchanged at 60.4%. The resilience of the labor market could impact the Federal Reserve’s decision on whether more rate hikes will be necessary to bring inflation under control.

- Inflation Rate

The 12-month inflation rate remained stable at 3.7% in September 2023.

According to Trading Economics, the monthly inflation rate declined to 0.4% from 0.6% in August, indicating a potential slowing in the rate of price increases for consumer goods and services. Energy costs fell by 0.5%, following a 3.6% decrease in August, primarily driven by a rebound in fuel prices. Additionally, prices increased at softer rates for food (3.7% vs. 4.3%), new vehicles (2.5% vs. 2.9%), apparel (2.3% vs. 3.1%), medical care commodities (4.2% vs. 4.5%), shelter (7.2% vs. 7.3%), and transportation services (9.1% vs. 10.3%). Costs for used cars and trucks, as well as medical care services, continued to decline. The core CPI, which excludes volatile food and energy prices, slowed to 4.1%, marking its lowest reading since September 2021. On a monthly basis, consumer prices advanced by 0.4%, easing from a 0.6% gain in August but exceeding market expectations of 0.3%, while the core rate remained unchanged at 0.3%.

- Interest Rate

The Federal Reserve maintained interest rates again at 5.50%.

According to CNBC, this continued pause could potentially be followed by another rate hike by the end of the year, depending on forthcoming economic indicators. Projections released in the Fed’s dot plot showed the likelihood of one more increase this year, then two cuts in 2024, two fewer than were indicated during the last update in June. That would put the funds rate around 5.1%. Along with the rate projections, economic growth expectations were sharply revised up for this year, with gross domestic product now expected to increase 2.1% this year. That was more than double the June estimate and indicative that a recession is not anticipated anytime soon. The 2024 GDP outlook moved up to 1.5%, from 1.1%.

- Business Confidence Index

The Manufacturing PMI® registered 49 percent in September, 1.4 percentage points higher than the 47.6 percent recorded in August. In October the Manufacturing PMI® registered 46.7 percent in October, 2.3 percentage points lower than the 49 percent recorded in September.

In October, the general economic landscape reverted to a declining phase following a brief month of growth in September. This came after nine months of downturn and a stretch of 30 months of continual growth. The New Orders Index also continued to decrease recording a figure of 45.5 percent, which is a decrease of 3.7 percentage points from September’s 49.2 percent. Similarly, the Production Index declined by 2.1 percentage points to 50.4 percent, compared to 52.5 percent in the preceding month. Prices Index however showed a minor increase, reaching 45.1 percent, up by 1.3 percentage points from September’s 43.8 percent. Among the top six sectors in manufacturing, only the Food, Beverage & Tobacco Products industry experienced growth in October.

- GDP Growth Rate

Real GDP grew at an annual rate of 4.9% in the third quarter of 2023. This is a surprisingly high number compared to what economists were expecting. This is also the best number of any quarter in years.

Conclusion

September’s economic indicators present a nuanced picture. While the unemployment and inflation rates remained stable, there was a slight decline in business confidence from September to October. The robust GDP growth for Q3 provides some cause for optimism. Stay with us as we continue to monitor these and other indicators as we progress into the final quarter of the year.