The economic landscape of the United States in 2023 continues to be a mixed bag as reflected by various indicators. The Consumer Confidence Index (CCI), Housing Debt, and Credit Card Debt Levels provide insights into the financial health and sentiment among American consumers. Meanwhile, the Nasdaq indicates how swiftly individuals and businesses are adapting to new technological advancements.

— SEPT 2023 SNAPSHOT —

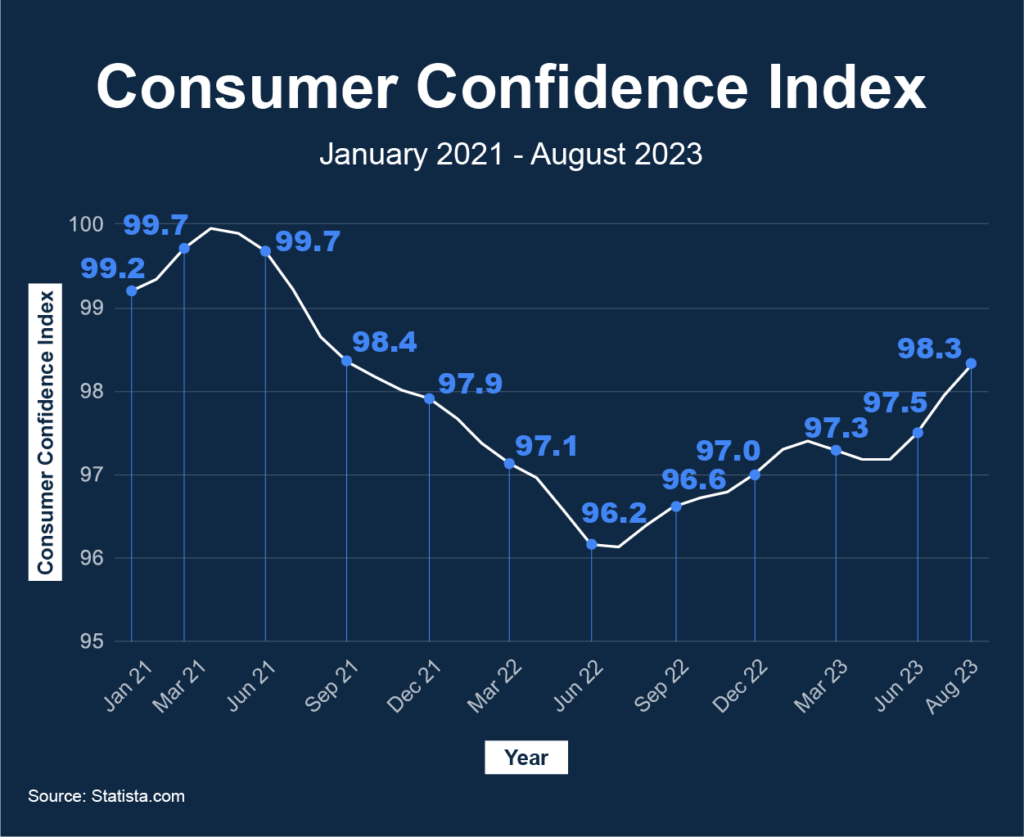

• Consumer Confidence Index: 98.32 (+0.38%)

• Housing Debt: $12.35 trillion (-0.1%)

• Credit Card Debt Level: $1.016 trillion (-1.45%)

• Nasdaq Composite Index: 13,219.32 (-6.4%)

- Consumer Confidence Index

The Consumer Confidence Index (CCI) increased from 97.95 in July to 98.32 in August. The increase represents a change of approximately 0.38%, indicating a slight improvement in consumer confidence over the month.This index is a significant indicator of consumer spending, which drives a large portion of the US economy. The rise in the CCI could potentially signal an uptick in consumer spending, although the longevity of this trend through the rest of the year remains under scrutiny.

- Housing Debt

There was a slight decrease in the housing debt between Q1 and Q2 of 2023. In Q1 the total Housing Debt in the US stood at $12.38 trillion. This number decreased to $12.35 trillion in Q2. The data shows a marginal decrease of $30 billion in housing debt, representing a 0.24% reduction from Q1 to Q2 2023. This decline suggests a slight easing in housing indebtedness over this period. Factors that contributed to this decrease include:

- More substantial mortgage repayments during this period, contributing to the decrease in total housing debt.

- Lower mortgage originations in Q2 2023 compared to Q1 2023 due to factors like rising interest rates, stricter lending standards, or a cooldown in the housing market.

- Changes in consumer behavior, such as a shift towards saving and debt repayment, driven by economic uncertainty or other factors, could also contribute to the decrease.

- Refinance packages comprised 30.7% of all loan originations in Q2 of 2023, which was down from 39.1% in Q2 of 2022 but slightly up from the prior quarter. These refinance activities might have some impact on the housing debt figures, but it’s not clear to what extent.

- Credit Card Debt Levels

– Q2 2023 Credit Card Debt Levels: The total credit card debt reached $1.031 trillion in Q2 2023, marking a significant milestone as it was the first time credit card balances surpassed $1 trillion. A notable increase of $45 billion was reported, which was a 4.6% rise from the previous quarter, bringing the total to $1.03 trillion.

– Q3 2023 Credit Card Debt Levels: As of September 27, 2023, the credit card debt level stood at $1.016 trillion.

The data indicates a slight reduction in credit card debt from Q2 to Q3 2023. Despite this, the levels remained notably high, continuing to hover around the $1 trillion mark. The figures reflect the evolving financial behaviors and economic conditions impacting consumers during these periods.

- Nasdaq Composite Index (Technology-focused).

In comparing the performance of the Nasdaq Composite Index for August and September 2023, there’s a notable downturn in the market conditions from August to September. The index registered a return of -1.7% in August, which further declined to -6.4% in September1. This deterioration marked a combined loss of 7.4% for the technology-centric Nasdaq Composite over these two months, a trend attributed to seasonal factors that traditionally affect the market during this period2. The negative trajectory in September was quite significant, with reported losses ranging from -3.9% to -10.0%, showcasing a challenging market environment during that month3. The movement of the index during these months reflects the broader economic and market dynamics that often come into play, influencing investor sentiment and market performance.

In conclusion, the US economic outlook in Q3 2023 is nuanced with indicators like the CCI and Housing Debt and Credit Card Debt painting a relatively positive picture, while the Nasdaq decrease presents a challenge. The rapid rate of technology adoption and changing consumer preferences towards sustainability are evolving trends that are reshaping the economic narrative, presenting both opportunities and challenges for businesses and consumers alike.